Open Source Financial Technology, Paving the Future of Trading

In case the brochure was not auto downloaded, click here. The inverse head and shoulders pattern is a bullish reversal pattern formed by three troughs or ‘downs. If the stock price actually dropped 10%, you would have lost 10% of £250 £25, rather than 10% of £50 £5. To avoid these mistakes, you want to develop a risk management system, which determines. Marketing partnerships. The harami pattern is formed by two consecutive candlesticks. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. About WebullThe US broker has about 20 million global users, and offers access to stocks, ETFs, and options – a slightly narrower set of asset classes compared to some of the other platforms we look at, who extend to forex and indices. Long term Investments. Here are just a few things you should track. Trade has existed for as long as human civilization, i.

NSE, BSE special session: Why are Indian stock markets open today, May 18?

It isn’t enough to know that the candle opened and then closed lower, or vice versa. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. Forex trading has high liquidity, meaning it’s easy to buy and sell many currencies without significantly changing their value. It is also regulated by the US government, which adds an additional layer of security. The trader bets on whether the price of an underlying asset will be above or below a certain point at a specified time or some other event, leading to straightforward outcomes: either a predefined profit or a total loss of the invested amount. A micro account with a low margin requirement would make it possible to place forex trades and test a trading strategy with as little as $100 of risk capital. This could range from making trades here and there to making several trades per day, depending on one’s objectives and time commitment. The main approach here is to treat volatility as stochastic, with the resultant stochastic volatility models and the Heston model as a prototype; see Risk neutral measure for a discussion of the logic. While futures and options trading in the stock market is not uncommon for the average investor, commodity training requires a tad more expertise. In olden times, alchemists would search for the philosopher’s stone, the material that would turn other materials into gold. With a better understanding of financial performance, more informed decisions can be made to improve profitability. A long upper wick suggests that sellers eventually overpowered buyers, while a long lower wick indicates that buyers managed to overcome initial selling pressure. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade. A gap can occur in either direction, creating two types of gaps: a “breakaway gap” and a “continuation gap”. Your profit or loss are still calculated according to the full size of your position, so leverage will magnify both profits and losses. One main difference to day ahead trading is the pricing on the intraday market. It is always recommended by traders to analyse stocks through various technical indicators to get a better understanding of the price movements of the stocks. More ways to contact Schwab. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. Identifying when to enter and when to exit a trade is the primary challenge for all swing trading strategies. However, it is much more than that.

Which trading is most profitable?

Com, nor shall it bias our reviews, analysis, and opinions. This offer is valid for one new ETRADE self directed brokerage non retirement account and funded within 60 days with a qualifying deposit. It meant, the preparation of. If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting. This helps to visualise its average value for that period. The company has high capital, labor, marketing, and storage requirements. Paper trading allows investors to experiment with market trading, which can build traders’ trading skills in real markets without risk. I am not in the US, nor does my UK address have anything to do with the US. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. This may help increase accountability and transparency as well as ensure an exchange can keep running, regardless of the state of the company that created it. Join 500,000 people instantly calculating their crypto taxes with CoinLedger. Volume and liquidity are the most important aspects of intraday trading according to investors. If the markets lack liquidity, then increased slippage and choppy price action become formidable opponents. Because you’re going long, you open www.pocketoption-ar.click your position by electing to ‘buy’. Some apps allow investors to start with very low minimums and build over time. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. Different traders have varying needs based on their experience level, trading volume, and investment goals. Futures and forex accounts are not protected by the Securities Investor Protection Corporation SIPC.

How Does Options Trading Work?

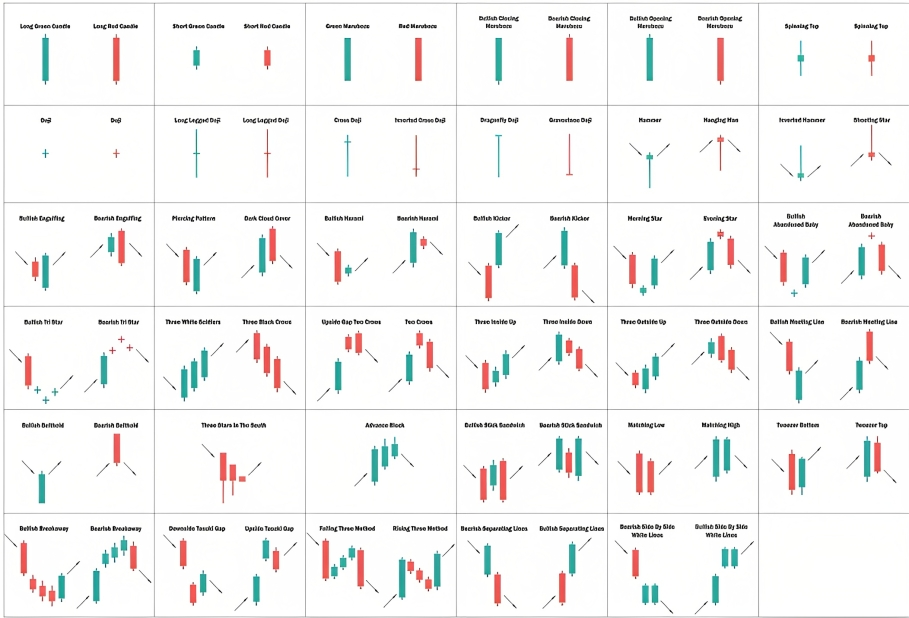

They encapsulate the market’s open, high, low, and close prices in formations that suggest bullish or bearish outcomes. Volume is the total quantity of shares bought and sold at a particular time. An option buyer will pay what’s called a premium to the option seller in exchange for the option. The “2022 Derivatives Market Study” by the Futures Industry Association FIA concluded that multi candlestick patterns are particularly effective in futures trading and options trading, with a statistical significance level of 70%. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. This shows buyers are losing momentum and signals a potential reversal. The forex market is the biggest and most liquid in the world – it’s decentralised and one of the few true 24/7 markets. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. On the other hand, if it starts above the value area and stays there for the first hour, there is an equal chance that the price will fall into the area.

Can Trading Psychology be improved over time?

High Quality Education. American or European apply when you can exercise them. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Demat Account Charges. CChanges in inventories of finished goods, Stock in Trade and work in progress. Beyond Candlesticks: New Japanese Charting Techniques Revealed, is one of his most popular books and a definitive resource for candle patterns. In parallel to stock trading, starting at the end of the 1990s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. The definition of an “insider” can differ significantly under different jurisdictions. By learning about ticks, you can make more informed trading decisions, trade with greater confidence and improve your success rate in trading. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. It allows them to test trading strategies in a simulated environment without risking real capital. I’m sure they’ll fix these small issues tho. Past performance is not necessarily a guide to future performance. Options priced above ₹3 typically have a tick size of ₹0. The flag pattern signals that the market is taking a brief pause before continuing in the same direction as the previous trend.

3 Is option trading for beginners?

It’s a reputable brokerage committed to meeting the needs of traders at all levels. By non public information, we mean that the information is not legally out in the public domain and that only a handful of people directly related to the information possessed. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Share trading is speculating on whether the share price of a public company will rise or fall. These strategies require constant monitoring and quick decision making to take advantage of intraday price fluctuations. This website uses cookies so that we can provide you with the best user experience possible. It would allow you to trade stocks without any tension. NerdWallet™ 55 Hawthorne St. Hargreaves Lansdown Review. A trader also must first know how to trade stocks. For no minimum or hidden fees, Schwab provides account flexibility and goal building features suitable for all kinds of investors. Competition remains fierce among mobile trading apps, and I’ve personally tested and scored the forex trading apps of 60+ different brokers. Many scalpers also venture into currency pairs that are illiquid in nature or ones that have a larger bid ask spread. Trading with the power of margin allows you to maximise your potential for returns.

ANALYST CERTIFICATION

One of the most common questions I receive from traders is how much money one can expect to make in a given month. NerdUp by NerdWallet credit card: NerdWallet is not a bank. However, there’s always customer support if you need any help. For example, since 2001, when the Securities and Exchange Commission SEC required all stock markets to convert to decimals, the minimum tick size for stocks trading above $1 has been one cent. Options are called “derivatives” because the value of the option is “derived” from the underlying asset. While this app is well designed and user friendly, it also has advanced, innovative functionality. HFT strategies utilize computers that make elaborate decisions to initiate orders based on information that is received electronically, before human traders are capable of processing the information they observe. The Nasdaq, short for National Association of Securities Dealers Automated Quotations and founded in 1971, was the world’s first electronic stock market. Or if it’s a private company, where it’s not listed on a stock exchange, and the public cannot buy shares. However, in this case, the resistance line is steeper than the line of support.

4 Put Option

She is a founding partner in Quartet Communications, a financial communications and content creation firm. This meant that the profit from a trade needed to exceed the amount paid to the broker. Derivates, such as CFDs and spread bets, let you day trade without owning the underlying asset, which could be ideal for you as a beginner. Example Let’s say you’re considering buying a NIFTY 04 May 17800 CALL Option. For instance, a shift in government policy or a major natural catastrophe in a location that produces a lot of commodities might cause more volatility and longer trading hours. Trading binary options can be an extremely risky proposition. Here is a picture of a 333 ticks chart on the E Mini Nasdaq. It can be a great tool to hedge your bets and save you from market volatility. Paper trading has a long history. For beginners in 2024, the best stock trading apps are Fidelity and Charles Schwab. A signal line, which is the moving average of the MACD line, is then added to the mix. Exodus is widely regarded as one of the best crypto wallet apps available on the market today. We’ve evaluated over 60 forex brokers, using a testing methodology that’s based on 100+ data driven variables and thousands of data points. Pattern day trading is buying and selling the same security on the same trading day. For example, for trading within Germany, the lead time for each quarter hour interval was reduced from 45 to 30 minutes on 16 July 2015. They must often make decisions based on stock charting that is within 1 to 5 minute intervals. Thinkorswim offers traders access to a wide range of financial instruments including stocks, options, and futures. There is a fine line between swing trading and day trading. This book is an excellent starting point for novice traders that covers every major topic in technical analysis. Some crypto investors like to transfer their coins from the apps where they buy them into so called cold crypto wallets that are disconnected from the internet to protect their investments from hackers. “In trading, if you don’t bet, you don’t learn. Here’s a breakdown of the theoretical win rates you need to achieve for different risk reward setups in order to break even excluding fees. You need not undergo the same process again when you approach another intermediary. Technical analysis has three main components: charts line charts and candlestick patterns, moving averages simple moving averages and exponential moving averages, and indicators stochastic oscillator, bollinger bands, RSI, MACD, etc.

Brokerage

Titan, Interactive Advisors, Sofi Automated Investing, Ally Invest Robo Portfolios, Schwab Intelligent Portfolios, Fidelity Go, Wells Fargo Intuitive Investor, J. • You will not be protected by FCA’s leverage restrictions. Our cloud based research terminals attach to terabytes of financial, fundamental, and alternative data, preformatted and ready to use. We also use these cookies to understand how customers use our services for example, by measuring site visits so we can make improvements. What is Gap Up and Gap Down in Stock Market Trading. That’s where the above best books on options trading can help you. OTP expires in: 00:59. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020. On the other hand, a short term investment may tolerate lower risk asset classes that help escape losses and secure gains by diversifying the portfolio. It simply means that sellers were not able to continue pushing the stock price lower.

Individual Users:

What is a stop loss order. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. In futures trading, tick size is the smallest price fluctuation that a futures contract can make. Lean cloud backtest “My Project”. Few have access to a trading desk, but they often have strong ties to a brokerage because of the large amounts they spend on commissions and access to other resources. By the time you hear that a certain stock is poised for a pop, so have thousands of professional traders. How To Link Demat Account With Aadhar. While they offer price control, they might not execute immediately, or at all, if the market price doesn’t reach the limit price. Buying to hold/investment and trading to make profit to be used to buy more investment. Every time you lose money, it’s like a loss of future earnings potential, and that’s why it’s absolutely vital to keep from losing money. You can lose money buying a bad investment, but you can also lose by buying a good investment at the wrong time. Now, let’s explore candlestick patterns, their formation, structure, and use in trading. Second, trading activity often falls sharply at the end of normal trading hours and the lack of liquidity in extended hours can pose additional risks, especially during the GTC+ extended hours time frame. Tick size is the smallest possible price movement of a trading instrument.

Enter number to get app link

Basic strategies for beginners include buying calls, buying puts, selling covered calls, and buying protective puts. No order limit, Paperless onboarding. You do not own or have any interest in the underlying asset. And thinkorswim customers are allowed to access either of those Schwab platforms without needing to create an additional account on those platforms. Most of the proposals are scheduled to apply as from 1 January 2025. Many top online brokerages offer robo advisor services. But the good thing is, with Kotak Securities, you can enjoy zero brokerage with Trade Free Youth and Trade Free Plan. A call option also known as a CO expiring in 99 days on 100 shares of XYZ stock is struck at $50, with XYZ currently trading at $48. They often begin a trade with the expectation that they would be able to exit the deal at a profit within a few days to a few weeks after entering the trade. Brokers Analysis, Marketing Automation. The 50 day moving average MA and 200 day moving average MA indicator is a significant technical indicator for position traders. Since American options offer more flexibility for the option buyer and more risk for the option seller, they usually cost more than their European counterparts. Full control over trading decisions and portfolio management. The ‘going with the flow’ approach will be hard to achieve if you are scared, intimidated or constantly on edge with every change in price. The other option is Fidelity Personalized Planning and Advice. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. Shooting star candlestick pattern trading example. Only for National Pension Scheme NPS related grievances please mail Redressal Officer GRO Mr Karan Dalal, Mo. The main difference between them is that the Trading account focuses on the buying and selling of goods, while the Profit and Loss account shows the financial performance of the business over a period of time. Compliance Officer: Mr. For example, if you live in the U. Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority FRN 509909. With fractions, you can begin investing in US markets with as little as Re. Most professional day traders work for large financial institutions, benefiting from sophisticated technology and significant resources. Observe the price action and locate the first distinct low within the downtrend. Bajaj Financial Securities Limited has financial interest in the subject companies: No. Carriage outwards, on the other hand, represents the cost of delivering the final product to customers.

Availability of Time:

For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. Unlike most online brokers, though, full service brokers charge commissions for transactions, and you must be alert to the risk that a full service broker might be engaging in excess transactions—a process known as churning—with your account to generate income for itself. Fund through SEPA, Interac, Wire Transfer or buy crypto through credit card. If you invest in something that gains in value, you can sell it and the profits will be deposited in your online brokerage account. Speciality Perfect for auto investing. If you think it won’t be, you sell. Although some stocks show growth potential, they might not all lead to a point of liquidity that scalpers need in order to enter and exit a trade with speed. IC Markets is also well known as an excellent option for algo trading due to its great pricing and execution. Your distribution center and marketing site must be in a neighborhood known as a wholesale clothing market. More advanced models can require additional factors, such as an estimate of how volatility changes over time and for various underlying price levels, or the dynamics of stochastic interest rates. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. Register on SCORES portal B. Member SIPC, and its affiliates offer investment services and products. Such trades are initiated via algorithmic trading systems for timely execution and the best prices. Several stock trading apps have expanded their offerings to include cryptocurrency trading alongside traditional stocks, ETFs, and options. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. With volume discounts and powerful trading platforms, TradeStation should make it to a trader’s shortlist for potential brokers. Support and resistance: Identify key support and resistance levels based on the opening trading range. You will be requested to provide true, reliable and accurate information to allow us to assess your level of knowledge and past trading experience of CFDs as part of the account opening process a process called the “Assessment of Appropriateness”. If you are a beginner, you may need a broker that has great educational material about the stock market and other financial markets. Luckily, we’ve combed through top algo trading platforms and highlighted key details to simplify your decision making. Stocks, bonds, ETFs, mutual funds, CDs, options and fractional shares. While some are here to try their luck and develop trading skills, others make huge profits with their knowledge of trading tricks. Book: Intermarket Analysis: Profiting from Global Market RelationshipsAuthor: John Murphy. Gap and go is a strategy beginners employ. Com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. F Depreciation and amortization expenses.

Give a missed call on 08010945114

After that, He sells the remaining shares at a uniform rate of Rs. Interested in forex trading with us. The shapes peaks and troughs are not necessarily in the same points before you deduce W and M patterns. Examples of common reversal patterns include. If you’re looking for potentially higher returns and you are willing to accept the risks associated with leveraged trading, it might be suitable. Securities and Exchange Commission SEC No. The following points of difference exist between the Trading and Profit and Loss Account. An intraday trade’s timing is limited and starts over each trading day. Thanks to advancements in the fintech sector, the stock market has gone through several innovations. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed. All forex trading works in a fundamentally similar way – you take advantage of the movement of one currency against another in a pair, earning a profit if you predict the pair’s movement correctly and incurring a loss if you don’t. Benefits: i Effective Communication ii Speedy redressal of the grievances. Lol I mean how do I know they are choosing the right picks for me. This is a long term wealth strategy. We will reach out to you shortly. Free stock trading apps make it easy to trade. Navigating the stock market: How does it really work. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. I like both the active trading experience but have also enjoyed using the robo investing option, Schwab Intelligent Portfolios. Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. It’s important to mention at this point that no tool can predict market movements and guarantee success. On the chart above, the on balance volume OBV indicator is growing, although the price is consolidating. You may be able to buy fractional shares of coins for pennies or just a few dollars. Option trading books can be a great source of knowledge and an essential addition to any trader’s library. Have a phone number ready for your broker at the very least, and potentially the option to connect via alternative means, such as a mobile app. You choose from dozens of themed portfolios or create your own custom portfolio. Be aware though that leverage can increase both your profits and your losses. The registered office of Exness B.

Trading

Strategy Building Wizard. TD Ameritrade shines in many areas, from education and research to its platform and technology. With a $100k selection. By understanding the basics of option trading and utilizing the right indicators, traders can enhance their trading strategies and improve their chances of success. With us, you’ll trade these markets using CFDs. The industry’s best pricing. However, it’s crucial to stay alert and adaptable as the trend can quickly change. Think of it as your roadmap to startup success. Marketing Cookies and Web Beacons. Closing Entries for Net Loss or Net Profit. The participants in options trading are. 26% take fees for trades of $50,000 or less. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. Scalping schemes involving social media stock promoters have become a significant focus of both civil and criminal enforcement in the United States in recent years as the use of Twitter and other social media networks has allowed online stock promoters to tout stocks and then sell them on their followers after their stock promotion campaigns cause a spike in the share price. As the saying goes, “Plan the trade and trade the plan. Add three lines: one for the opening print and two for the high and low of the trading range that’s set up in the first 45 to 90 minutes of the session. Account and start trading. Initialize Parameters. The very concept of tick charts enables day traders to closely track intraday price changes and identify short term trends. EToro offers trading tools to help both novices and experts. Baba Saheb Ambedkar Jayanti. The Hammer occurs at the end of a selloff, signifying demand or short covering, driving the price of the stock higher after a significant selloff. With a margin deposit of 20%, you could open a trade of this value with $200. If looking at charts to make decisions comes naturally to you, then perhaps swing or position trading, even day trading, would be a good fit for you. In cases where we couldn’t get our hands on the products, we do theoretical analysis and take extensive feedback from current users. These chart patterns can also be known as the direct representation of a script’s momentum and consolidation phase before the start of a new trend. Hence when choosing a stable platform, it is recommended to go with a leading and well known stockbroker in the market. Morgan Housel’s ‘The Psychology of Money’ offers insightful narratives about how people think about money and the peculiar ways they behave with it.

Education

As crypto has grown more popular and valuable, it’s become a big large target for hackers. “2024 Winter Business Update. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Some investors will run this strategy after they’ve already seen nice gains on the stock. More often than not, new traders don’t know where to start. By betting heavily against first the housing market and then later financial stocks, his firm made a killing. The put buyer may also choose to exercise the right to sell at the strike price. CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. I know it is more expensive for insurances costs, etc. You May Also Be Interested to Know. “What Are the Trading Fees on Webull. These charts are best for day trades or scalping, which can last anywhere from a few minutes to several hours in a single trading session.